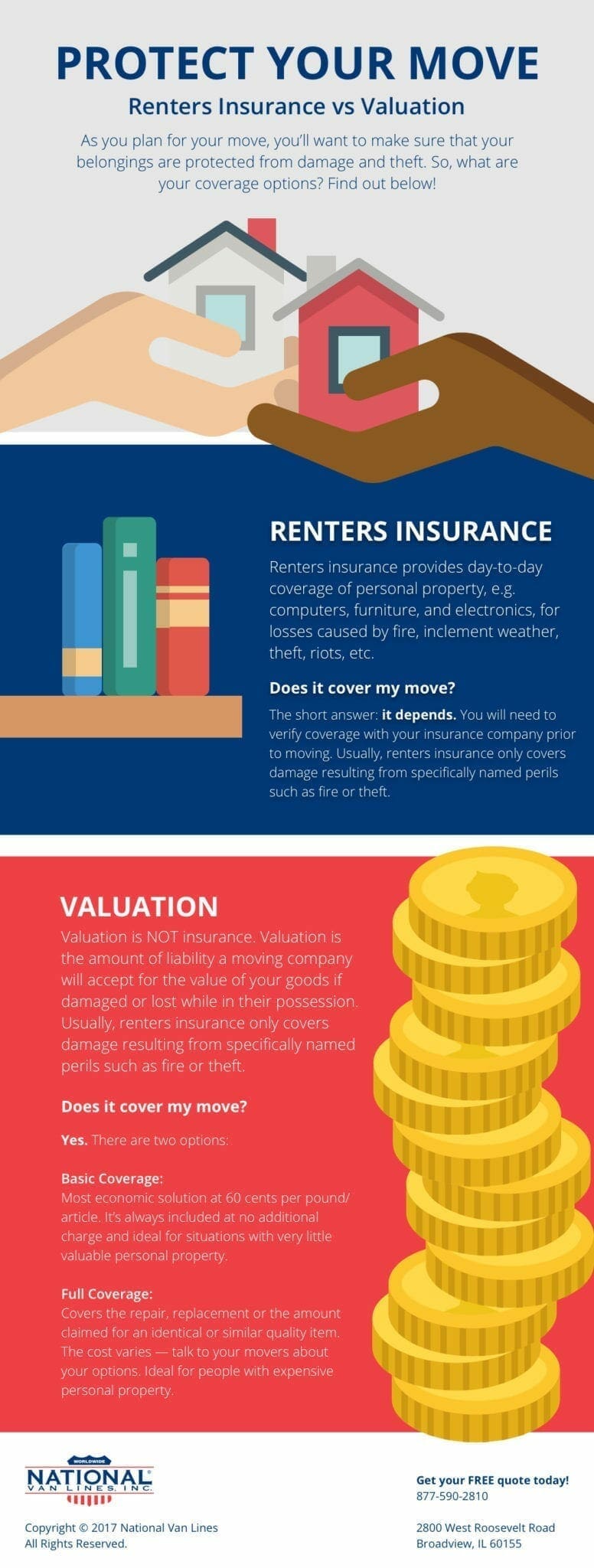

We live in a human world, meaning mistakes can happen even when our planning, preparation and organization is perfect. This is one of the reasons we always stress valuation, especially during long-distance relocations. Valuation protects your belongings, obligating the moving company to repair, replace or compensate anything damaged or lost. There is one other place to look when it comes to preparing your belongings for their long transit. Investigate your current renters or homeowners insurance to see if they cover moving damage.

You’re Covered, But…

While many insurance companies do cover moving damage, this coverage tends to be limited, and you will need to verify coverage with the insurance company before moving. Remember that renters insurance policies usually only cover damage resulting from specifically named perils such as fire or theft. Some types or specific causes of damage are explicitly not covered, and all renters insurance policies have limits.

So does renters insurance cover moving damage? Some renters insurance policies will be only used as coinsurance during the moving process (meaning your insurance company will expect you to buy valuation protection from your mover before they cover your losses). Ask detailed questions about the deductible and any limits on how much they will pay, and always make sure you have enough coverage to handle a worst-case scenario.

Typical Coverage Scenarios

- Say for example, that recent forest fires have caused smoke damage to your home, and you are relocating your family because your house is uninhabitable. Your renter’s insurance will help pay for the moving expenses, and additional coverage is going to be in effect for your insurance company and the moving company

- You decide to move without a professional moving company (and valuation protection), and your trailer is robbed while parked outside of a hotel. Renters insurance covers some of the items, up to their limits, but the rest will be out of your pocket.

- You hire professional movers for valuation protection, and the shipment is lost due to a vehicular accident. First, the at-fault driver’s auto insurance will provide coverage, the moving company will provide additional coverage, and your renter’s insurance may cover remaining property damage. You may not have to go to court—your insurance company will do this for you.

Moving Company Valuation

Regardless of the information you get from your insurance company, be sure to ask your mover about valuation. Valuation, which should not be construed as insurance, is sure to protect your items from the moment movers touch them to when they unload them at their destination. Typical renters/homeowners insurance has a deductible between $250-$1000. While some moving companies may offer the same, there are plans where the deductible can be as low as $250 with minimal premium cost.

The greatest benefit of valuation over your insurance is your premium. Filing a claim through your renter’s insurance will likely increase your premium and monthly payments. Over time, the increased payments may amount to more than the one-time fee you will pay for valuation. The protection covered by valuation will not have any effect on other insurance you hold.

What’s the Catch?

Valuation purchased through a moving company covers the cost of any transit damages or loss caused by the company. If an item loaded on the truck goes missing or if a loader happens to drop something, valuation will cover you. However, if you choose to pack your belongings yourself using your own packing supplies, valuation will not cover damage caused by your packing techniques.

But with a professional moving company, you don’t even have to worry about the heavy work. Most moving companies are happy to take responsibility for your packing, packing supplies, loading and unloading. Talk with your moving company to see what they have to offer.

Protecting your belongings during your cross-country move is extremely important. Be sure to ask questions of both your moving company and insurance company. Whether you choose to have professional movers do all the packing and moving for you or if you’d like to do some of it on your own, you can take comfort in knowing everything you own is in good hands.

What Are Your Valuation Options?

There are two types of valuation offered by National Van Lines: Basic Coverage and Full Value Protection. Basic coverage protection is the most economic solution, and it’s at 60 cents per pound per article. This is included at no additional charge, and it’s ideal for situations with very little valuable personal property.

Full value protection can be chosen with or without a deductible, and covers the repair, replacement or the amount claimed for an identical or similar quality item. This option is especially valuable for people with expensive personal property that would be difficult or expensive to replace (such as electronics, furniture, appliances, or jewelry).

Ask our professional movers about valuation and get a free moving quote today. Contact us at 877-590-2810 for more information.